Hilton Head Island, Bluffton, & The Surrounding SC Lowcountry

When insuring your home in the South Carolina Lowcountry, you will need purchase at least two or three types of coverage, each under separate policies: Home Owner’s Insurance, Wind & Hail Insurance and Flood Insurance.

When insuring your home in the South Carolina Lowcountry, you will need purchase at least two or three types of coverage, each under separate policies: Home Owner’s Insurance, Wind & Hail Insurance and Flood Insurance.

Homeowners Insurance

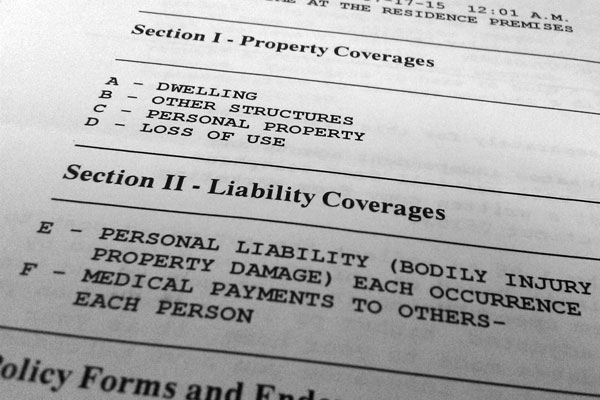

A Home Owner’s Policy combines various personal insurance protections, which can include losses occurring to one’s home, its contents, loss of use (additional living expenses), or loss of other personal possessions of the homeowner, as well as liability insurance for accidents that may happen at the home or at the hands of the homeowner within the policy territory.

Wind and Hail

In other areas, coverage for wind damage might be included in your home owner’s policy. In South Carolina, that is not the case. Wind and hail damage is covered in a separate policy backed by the State and issued through the South Carolina Wind and Hail Association. Typically homes have a 1% to 10% deductible. If damage occurs as a result of a wind storm, the deductible is 1% of the home value. If damage occurred as a result of a “named storm” or hurricane, the deductible is 3%. Policy holders can increase the deductible up to 10%. Remember that wind and hail does not cover water damage caused by a storm. That falls under flood insurance.

Flood Insurance

Flood insurance is offered through the Federal Flood Program. There are some basics to flood insurance that are generally true. The maximum coverage for a policy is $250,000 on the dwelling and $100,000 contents. Factors that affect rates can include, but are not limited to location and elevation, the year the home was built, ventilation and other factors related to construction and building codes. There have been major adjustments to regulations surrounding flood insurance in the last few years, and it is best to speak with an insurance agent to get up to date information and answers to your questions related to a specific property or type of property.

Condos, Regimes and Insurance

When purchasing a condo, villa and sometimes a townhome, you may have a regime fee that includes certain types of insurance coverage. These policies generally cover from the exterior framing inward, but do not cover the fixtures and installations within the unit. Items such as granite countertops, bathroom and kitchen fixtures, and the flooring would not be covered by a master policy. You will want to know the details to the master policy, if it is included to determine what additional coverage you need. Questions to ask include:

Hilton Head Island Real Estate Brokers continues to keep up with all the current information with regards to insuring your property. While we can address a number of your questions about insurance, the best advice we can give is for you to speak directly with a local insurance agent.

Below is a list of local insurance agents our clients, friends, and family have used over the years. Reach out to any one of them and they would be happy to answer any of your questions!

| BB&T Carswell Services 2 Westbury Pkwy #103 Bluffton, SC 29910 | Pat Wells pkwells@bbandt.com https://insurance.bbt.com | (843) 816-0523 office |

|---|---|---|

| Brightway Insurance 50 Burnt Church Rd, Suite 200-C Bluffton SC 29910 | Greg Dissel Gregory.dissel@brightway.com | 843-480-9933 office |

| Callen Insurance Services, LLC 1036 William Hilton Parkway Suite A | Rich Tiffany rich@callenins.com www.callenins.com | (843) 681-2221 office |

| Carolina Heritage Insurance 92 Main Street, Suite C Hilton Head Island, SC 29926 | John Alagna john@csarolinaheritage.net www.carolinaheritage.net | (843) 689-3030 ext 202 |

| Carolina Heritage Insurance 92 Main Street, Suite C Hilton Head Island, SC 29926 | Dan Waymont dan@carolinaheritage.net | (843) 689-3030 Office |

| Correll of Hilton Head 15 Bow Circle, Suite 101 | Jeff Halseth jeff@correllhhi.com www.correllhhi.com | (888) 668-8082, Ext.23272 office |

| The Farm Bureau Insurance 281 Parris Island Gateway Beaufort, SC 29906 | Ty O’Farrell tyofarrell@scfbins.com www.scfbins.com/ | (843) 812-2786 cell (843) 522-0031 office |

| HUB International - HHI 50 Palmetto Bay Road Hilton Head Island, SC 29928 | Kristin Hayrinen Kristin.hayrinen@hubinternational.com | 843-686-0709 office |

| Seacoast Insurance 88A Main Street Hilton Head Island, SC 29926 | www.seacoastinsurance.com | (843) 341-1676 office |